IMAGE:Cryptocurrencies are actually a secure financial haven throughout the COVID-19 pandemic. (Source: Acid reflux Altmann via Pixabay) view more

Credit: Source: Acid reflux Altmann via Pixabay

The SARS-CoV-1 coronavirus pandemic leaves a substantial footprint around the global economy. Because of this, it’d a considerable effect on the conduct of financial instruments, including cryptocurrencies. Apparently , the fluctuations felt by the virtual currencies market during this time period reflect alterations in other capital and commodity markets. The forex market has additionally proven relative stability in this hard time. It’s another proof that cryptocurrencies may be treatable like a mature and full-fledged financial instrument.

Social systems are characterised with a vast network of connections and factors that may influence their structure and dynamics. Of these systems, the whole economic sphere of human activity appears is the most interconnected and sophisticated. All markets fit in with this sphere, such as the youngest of these – cryptocurrencies.

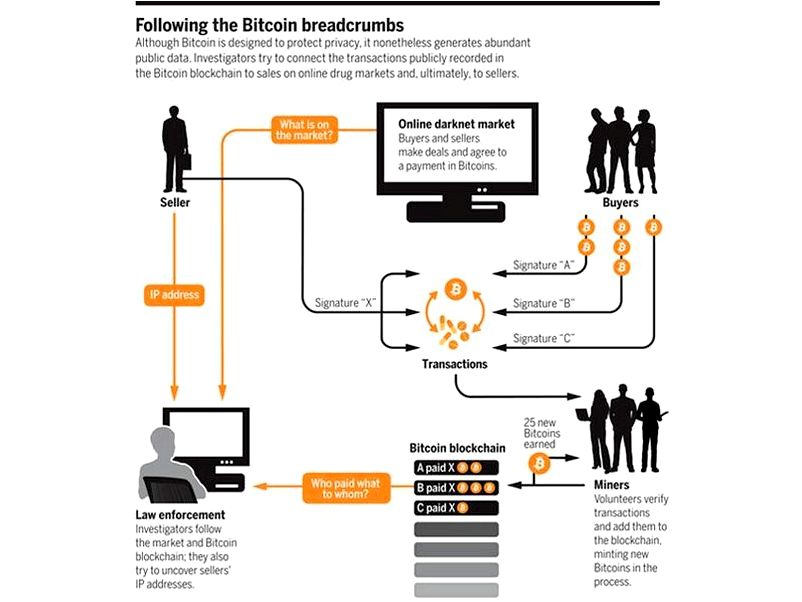

The very first cryptocurrency – bitcoin – made an appearance in 2008 in the height from the global financial trouble. Its creators intended to supply a tool for transporting out transactions online with no participation of the central unit handling the issue of cash. Out of this perspective, cryptocurrencies can be viewed as being an independent financial instrument. However, has got the cryptocurrency market resided to the hopes put into it? How made it happen respond to the problem brought on by the emergence of crisis conditions? And also have cryptocurrencies already arrived at the maturity and stability needed of the full-fledged financial instrument?

Occasions associated with the outbreak and growth and development of the COVID-19 epidemic provided a great chance to find solutions to those questions. Several scientists in the IFJ PAN in Krakow lead by Prof. Stanislaw Drozdz made the decision to review the conduct from the cryptocurrency market as a result of the economical situation brought on by the coronavirus.

“Our previous quantitative analyses of the several characteristics from the complexity from the cryptocurrency market and also the more knowledge about its correlation with increased traditional world markets, for example stocks, currencies or goods, demonstrated this market during these aspects grew to become basically indistinguishable and independent from their store. Using the pandemic ahead, however, we seriously considered the chance that investors would begin to eliminate something similar to bitcoin to begin with. Because of their virtuality, most potential market participants still see cryptocurrencies as quite peculiar products. In occasions of crisis, during violent economic and political turmoil, people turn to financial sources they consider more reliable. But our comparisons demonstrated that solid instruments recorded drops at most critical moments, while cryptocurrencies socialized a lot more stable,” states Prof. Drozdz.

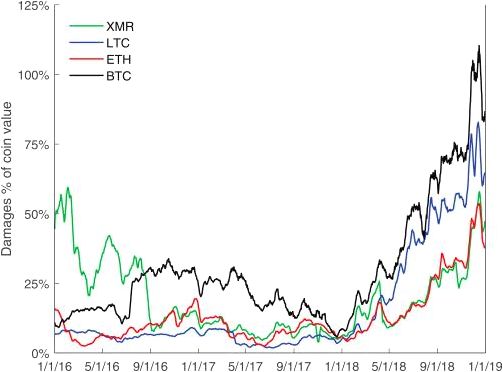

Within the first phase from the pandemic, when it wasn’t known the way the whole situation would develop, there is a getaway from dangerous financial instruments to bitcoin. You could observe an optimistic correlation of bitcoin with financial instruments considered safe, like the Swiss franc, Japanese yen, silver and gold. There would be a further rise in the amount of infections all over the world and also the connected sharp drops in global stock markets – mainly in the US – as a result of total sell-from all assets, including bitcoin. Investors resorted to cash, mainly the yen and also the dollar. During this time period, bitcoin lost its safe-haven status, however the same was the case with silver and gold. Still, it socialized just like a regular, traditional, and reliable financial instrument. Really important may be the correlation of bitcoin (BTC) and ethereum (ETH) with conventional financial instruments throughout the spikes on global stock markets because the epidemic slows lower throughout the summer time of 2020.

“It is really an intriguing effect since there weren’t any such correlations prior to the pandemic, plus they stay at a substantial level. It might be proof that bitcoin has turned into a full-fledged aspect of the financial market. It’s possible to state that the COVID-19 pandemic has positively verified cryptocurrencies. It switched out that investors weren’t scared of bitcoin just the opposite – they incorporated it within their domain portfolios,” Dr. Marcin Watorek describes the study findings.

Scientists from Krakow centered on the dynamic and structural qualities from the cryptocurrency market. They examined data showing the forex rates of 129 cryptocurrencies around the Binance platform. Case study contained three parts targeted at analyzing another part of the market structure.

“We contacted the subject from three standpoints: the dynamics from the cryptocurrency forex rates with other virtual and fiat currencies, coupling and decoupling of cryptocurrencies and traditional assets, and also the inner structure from the cryptocurrency market. We used data from The month of january 2019 to June 2020. This era covers the particular duration of the COVID-19 pandemic we compensated special focus on the wedding and examined how strong its impact was around the structure and dynamics from the market. The examined data include other significant occasions, like the double bull and bear phase in 2019,” Dr. Jaroslaw Kwapien explains the methodology from the work.

The research into the mix-correlation between your cryptocurrency market symbolized through the BTC/USD and ETH/USD exchange rate and also the traditional markets of major fiat currencies, major goods (for example oil and gold) and US stock indices brought towards the conclusion the cryptocurrency market was separate from other markets throughout 2019, but temporarily correlated using these markets during several occasions within the first 1 / 2 of 2020, for example in The month of january, once the first COVID-19 situation was reported within the U . s . States, in March throughout the pandemic outbreak, and from May to This summer 2020 throughout the second wave from the pandemic. Within the first situation, bitcoin demonstrated anti-correlation with major stock indices like the S&P500 and Nasdaq100, however in the 2nd and third cases, the related correlations were positive. The correlations between bitcoin and many fiat currencies and also the commodity market were also positive of these phases.

The possible lack of statistically significant correlations in 2019, when classic financial instruments experienced no turmoil, was presumably because of market cap asymmetry between your cryptocurrency market and traditional markets towards the drawback to the previous, that is still they canrrrt have significant effect on other markets. However, traditional markets can certainly influence the cryptocurrency market once they become turbulent. This is exactly what happened in March and June 2020.

“The most important consequence of our analyses from the dynamics from the world’s markets throughout the COVID-19 pandemic would be that the cryptocurrency market, and particularly bitcoin, switched to be probably the most resistant against turbulence felt by all global markets during this time period. This observation is consistent with and complements our formerly printed results around the contacted stability and maturity from the cryptocurrency market previously 2-three years. The COVID-19 period appears to verify individuals earlier signals”, Prof. Drozdz summarizes the job.

###

The Henryk Niewodniczanski Institute of Nuclear Physics (IFJ PAN) is presently the biggest research institute from the Polish Academy of Sciences. The wide range of studies and activities of IFJ PAN includes fundamental and applied research, varying from particle physics and astrophysics, through hadron physics, high-, medium-, and occasional-energy nuclear physics, condensed matter physics (including materials engineering), to numerous applying ways of nuclear physics in interdisciplinary research, covering medical physics, dosimetry, radiation and ecological biology, ecological protection, and other associated disciplines. The typical yearly yield from the IFJ PAN encompasses greater than 600 scientific papers within the Journal Citation Reports printed through the Clarivate Analytics. Negligence the Institute may be the Cyclotron Center Bronowice (CCB) that is an infrastructure, unique in Central Europe, to function as a clinical and research center in medical and nuclear physics. IFJ PAN is part of the Marian Smoluchowski Kraków Research Consortium: “Matter-Energy-Future” which offers the status of the Leading National Research Center (KNOW) in physics for that years 2012-2017. In 2017 the ecu Commission granted towards the Institute the HR Excellence in Research award. The Institute is of the+ Category (leading level in Belgium) in the area of sciences and engineering.

CONTACTS:

Prof. Stanislaw Drozdz

Institute of Nuclear Physics of Polish Academy of Sciences

Tel: +48 12 662 8220

Email: stanislaw.drozdz@ifj.edu.pl

SCIENTIFIC PAPERS:

1. Stanislaw Drozdz, Jaroslaw Kwapien, Pawel Oswiecimka, Tomasz Stanisz and Marcin Watorek “Complexity in Social and economic Systems: Cryptocurrency Market around COVID-19” Entropy 2020, 22(9), 1043 DOI: 10.3390/e22091043

Resourse:https://eurekalert.org/pub_releases/2020-11/thni-bic111220.php